Ask for new bills in larger denominations: If you’re using cash, it’s easier to spend old, worn bills rather than crisp bills. It’s also harder for us to justify breaking a $100 rather than a $10.

Having more money in your wallet or bank account may be easier than you think. You don’t have to change professions or live solely on Saltines to make sure you have extra spending money. Sometimes, saving money is as simple as tricking your mind.

A few bucks saved, here and there, can quickly add up. These tips for making your wallet a little fatter can go a long way if you let them. It’ll just take a little bit of work. Check them out!

“Shrink” your phone data: By using apps like Onavo, you can make your phone more efficient and avoid overage charges (if you don’t have an unlimited data plan). It also tracks how much data each app eats.

Find the best airfare by clearing your browsing history: Airlines and travel sites use your browser’s cookies to see how often you search for flights… and use it against you.

Buy discounted gift cards and use them yourself: Gift card exchange sites like CardCash, GiftCardGranny and CardHub.com allow people to sell their unwanted gift cards at a discount.

Some insurance policies can help you save money: Reimbursements or discounts on gym memberships, renter’s insurance, rental car insurance can be granted depending on your other insurance policies. Make sure to read the fine print.

Make sure to time your shopping: Buying items during certain times of the year will help you save money. Just like summer clothing going on sale at the end of summer or the beginning of fall, other goods have seasonal sale trends.

Be aware of how amenities may increase your rent: Having a laundry in your own unit can increase the rent, as well as air conditioning. Being far from a city center can also drastically help you save money on rent.

Use your smartphone as much as you can: Most people use their phone for calling, texting, browsing the net, social media and GPS… but you can do so much more. Your phone can even help make you money. Gigwalk, Field Agent and TaskRabbit can help you make money by running errands or doing small tasks for others.

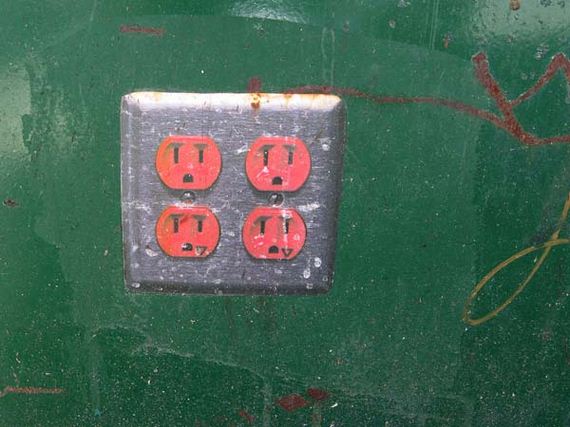

Avoid “vampire charges:” These are also known as trickle charges. They are what you pay to keep your appliances and electronics plugged into the wall while you’re not using them. Unplug it if you’re not using it.

Don’t let your old cell phones gather dust: Sell your old smartphones, cameras and computers online. Gazelle, USell, Craigslist and eBay can help you get a couple hundred dollars for your old tech you no longer use.

Avoid “vampire charges:” These are also known as trickle charges. They are what you pay to keep your appliances and electronics plugged into the wall while you’re not using them. Unplug it if you’re not using it.

Be aware of your home’s temperature: Avoiding running your heat during the winter and turning the thermostat down can save you about 3% per degree. Also avoid using scalding hot water during showers.

Barnorama All Fun In The Barn

Barnorama All Fun In The Barn